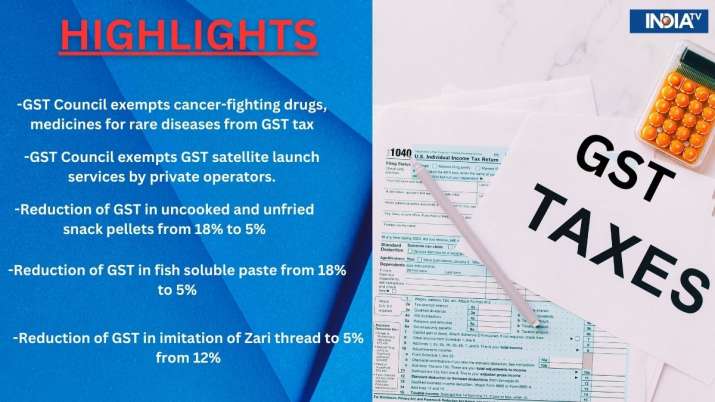

The omnipotent Goods and Services Tax (GST) Council on Tuesday determined to exempt cancer-fighting drugs and medicines for rare diseases from the levy.

The panel, headed by the Union finance minister Nirmala Sitharaman and comprising representatives of all states and UTs, additionally lowered the service tax levied on meals and drinks consumed in cinema halls to five per cent and tweaked the definition of an SUV for attracting a cess over and above the GST charge.

Now, the SUV definition will embrace solely the size (4 meters and above), engine capability (1,500 cc and extra), and floor clearance (unladed clearance of 170 mm and extra), she mentioned.

On the tax levied on meals and drinks served in cinema halls, the GST Council determined to levy 5 per cent GST, equal to the tax on eating places, and not 18 per cent as is relevant on cinema halls.

28 per cent GST charge will now be levied on full worth of gaming

She mentioned the panel determined to levy a 28 per cent GST on the face worth or funds made for taking part in on-line video games, bets in casinos and on racing.

The tax charge was determined primarily based on the advice of a bunch of ministers that checked out taxing casinos, horse racing and on-line gaming. The challenge earlier than the GoM (group of ministers) was whether or not to impose a 28 per cent GST on the face worth of bets, or gross gaming income, or simply on platform charges.

Sitharaman mentioned the tax can be levied on the whole worth. The tax on on-line gaming corporations can be imposed with out making any differentiation primarily based on whether or not the video games required talent or have been primarily based on probability.

To considerations of the gaming trade that tax on the whole worth would kill the trade, she mentioned, “we are not killing any industry” however gaming and playing can’t be given a remedy lesser than important trade.

“So the moral question was also discussed (at the Council meeting on Wednesday). It does not mean they be promoted more than essential industries,” she mentioned.

(With inputs from company)

Also Read: fiftieth GST Council meet: What can be costlier, cheaper | Full checklist