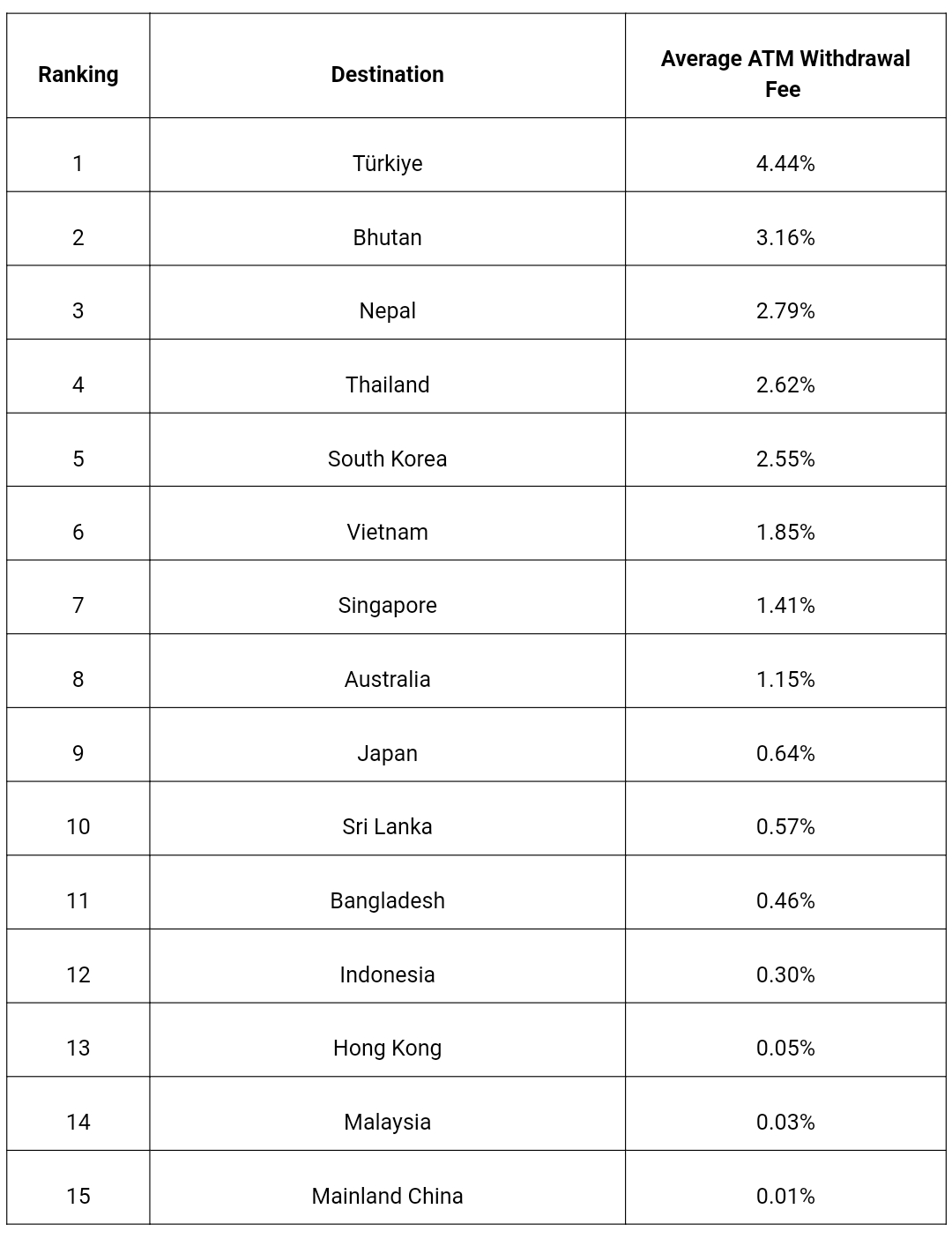

On the flipside, locations corresponding to Malaysia, Indonesia and Hong Kong have friendlier ATM charges beneath 1%. (Representative picture)

Among a few of the fashionable locations for Indian travellers, Thailand has a mean ATM withdrawal charge of two.62%, Singapore at 1.41% and Australia at 1.15%

Wise, the international trade monetary know-how firm, not too long ago revealed essential insights into ATM withdrawal charges for Indian travellers visiting fashionable APAC locations. The newest analysis tapped on its database to make clear the potential prices related to money withdrawals overseas, serving to travellers to get essentially the most out of their trip budgets.

The knowledge, specializing in locations in APAC, revealed that Türkiye topped the checklist as the most costly place within the area to withdraw money at ATMs, with travellers charged 4.44% per transaction on common.

As the brand new yr commences and with an growing variety of Indians waiting for worldwide journey, these insights present precious steerage for smarter monetary planning all through 2024.

Among fashionable journey locations for Indians, Thailand ranked fifth at 2.62%, adopted by South Korea (2.55%), and Vietnam (1.85%). In distinction, mainland China and Malaysia have a few of the lowest charges at 0.01% and 0.03% respectively.

ATM charges in main APAC journey locations:

To put this into perspective, if somebody withdrew Rs 10,000 per day for per week in Türkiye, they’d pay an equal of Rs 3,108 in charges. In distinction, in the event that they visited Malaysia and took out the identical amount of money, they’d solely pay Rs 21 in transaction charges.

When transacting in a special forex, it’s vital to pay attention to potential hidden bills, which may typically embrace international transaction charges and undisclosed trade price markups. These seemingly small costs can add as much as a considerable quantity.

Surendra Chaplot, head of worldwide product, Wise, mentioned, “When it comes to international payments, it’s crucial to be aware of potential hidden expenses, which can often include foreign transaction fees and undisclosed exchange rate markups. This affects anyone who has ever needed to move or manage money in a different currency, including withdrawing cash abroad. Wise is dedicated to raising consumers’ awareness about hidden fees in all forms of cross-border payments, so that they can make the most out of their money.”

To assist Indian travellers make knowledgeable monetary choices and stretch their vacation finances throughout worldwide journeys, Wise has additionally put collectively the following pointers for holidaymakers to remember:

- Research the place to withdraw cash. It could also be least expensive to do that earlier than leaving, however keep away from cash exchangers on the airport. If you actually need to withdraw money overseas, contemplate evaluating ATM charges at a number of places, as charges can differ from financial institution to financial institution.

- Check the charges your card supplier costs for abroad withdrawals, which could be costly.

- Some suppliers provide free ATM withdrawals overseas as much as a sure threshold.

- When swiping your card in shops, select to pay within the native forex as an alternative of in Rupees to keep away from dynamic forex conversion costs

- If you’re travelling to go to family and friends, think about using credible platforms/apps to ship cash to those that may also help to withdraw at a neighborhood ATM. This method, you keep away from costly ATM charges, international transaction charges and poor trade charges suddenly.

Methodology of the research

Wise mentioned that the information relies on 8.4 million analysed money withdrawals made with a Wise Card at third social gathering ATMs over 6 months, from May 2023 to November 2023. These ATMs recorded not less than 500 transactions per nation throughout the 6 months.