A separate Reuters survey concluded one other wave of infections in India was possible by October.

The nation’s financial rebound, already weakened in current months, might lose additional momentum as coronavirus variants pose the best menace and inflation rises, a Reuters ballot of economists discovered.

The newest survey outcomes recommend troublesome coverage choices lie forward for the Reserve Bank of India, which has already seen two consecutive months of inflation above the six per cent higher restrict of the vary it tolerates.

The RBI mentioned final week that prospects for the economic system had brightened and the inflation rise could be transitory, echoing the views of most main central banks.

But the quick unfold of the Delta variant in some states – and it’s changing into dominant around the globe – has raised doubts because the nation contends with a devastating wave of COVID-19.

The July 15-22 ballot of 52 economists confirmed a 3rd consecutive downgrade to the expansion outlook for the present fiscal yr 2021-22, but additionally the third such improve to the next yr.

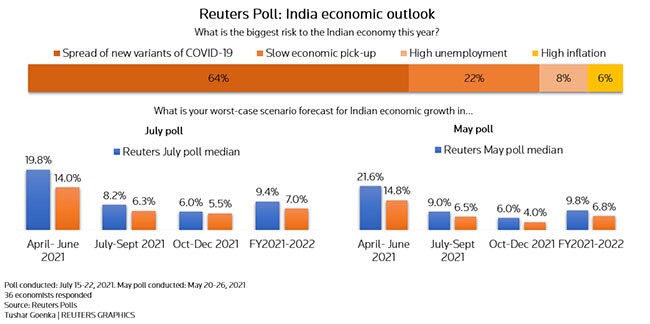

About two-thirds of economists, or 23 of 36, who responded to an additional query mentioned virus variants have been the most important danger, whereas solely a handful cited excessive inflation.

“Resurgence in cases and (any) emergence of fresh variants are notable risks for the economy for the rest of the year, particularly at a time when vaccination coverage is short of achieving a critical mass,” mentioned DBS economist Radhika Rao.

“Reinstatement of movement curbs risks deepening the damage inflicted on the informal sector, which contributes to nearly half of the national output and employs a majority.”

Reuters ballot graphic on India financial outlook

Photo Credit: Reuters

A separate Reuters survey of worldwide well being specialists final month concluded one other wave of infections and COVID-19 in India was possible by October.

After contracting within the earlier fiscal yr at its quickest annual tempo since information started over 4 a long time in the past – one of many worst-hit in Asia, the economic system was predicted to broaden 9.4% within the present fiscal yr. The final time the economic system grew that shortly was in 2010.

The newest consensus forecast was a downgrade from 9.8 per cent within the earlier ballot in May, itself down from 11.0 per cent in April, and barely beneath the RBI’s newest projection of 9.5 per cent.

Asked for his or her worst-case situation this fiscal yr, economists offered a median seven per cent, in a 5 per cent- 9 per cent vary. Growth in any case was anticipated to sluggish to six.9 per cent in fiscal 2022-23.

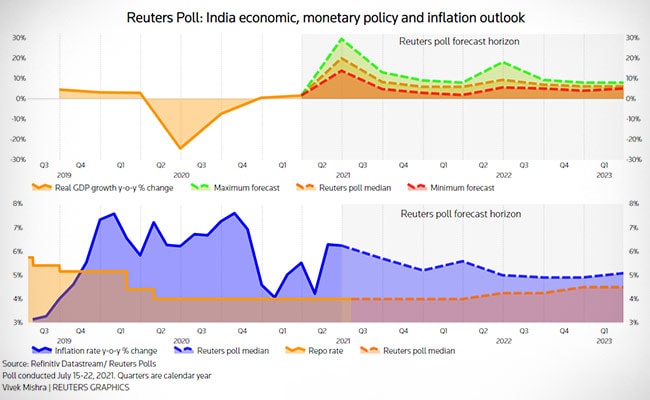

Reuters ballot graphic on India financial development, financial coverage and inflation outlook –

Photo Credit: Reuters

Inflation Lingers

Although inflation was forecast to ease from 6.3 per cent on the final measure, the consensus was for it to common above the mid-point of the RBI’s medium-term goal of two per cent-six per cent not less than till early 2023.

Inflation was predicted to common 5.5 per cent and 4.7 per cent within the present fiscal yr and subsequent, up from 5 per cent and regular with 4.7 per cent predicted in May. For now, the RBI is anticipated to maintain its coverage charges unchanged as inflation seems to be coming off a peak.

But the consensus pointed to 2 25 foundation level hikes every subsequent fiscal yr, taking the repo price to 4.50 per cent by end-March 2023, with 32 economists now predicting not less than one hike by early that yr in contrast with 24 within the earlier ballot.

“Despite the growth concerns, we think the RBI will eventually need to act to bottle the inflation genie so as not to lose control. We therefore expect monetary policy normalisation to start relatively soon,” famous Kunal Kundu, India economist at Societe Generale.

“However, with a third wave of the pandemic appearing to be a certainty, with experts pointing to the less than desirable pace of vaccination, the precise timing of normalisation remains uncertain.”