Check tips on how to apply SBI Gold mortgage on-line

SBI Gold Loan will be availed by pledge of gold ornaments together with gold cash offered by Banks.

In India, a gold mortgage is a sort of secured mortgage the place debtors pledge their gold ornaments or cash as collateral to obtain a mortgage from a lender. The mortgage quantity is normally a proportion of the gold’s worth.

SBI Gold Loan will be availed by pledge of gold ornaments together with gold cash offered by Banks.

Features of SBI Personal Gold Loan

- Maximum mortgage quantity that may be sanctioned is Rs 50 lakhs

- Minimum mortgage quantity: Rs 20,000

-Margin

- Gold Loan (EMI primarily based): 25%

- Liquid Gold Loan (Overdraft): 25%

- 3 Months Bullet Repayment Gold Loan* : 30%

- 6 Months Bullet Repayment Gold Loan*: 30%

- 12 Months Bullet Repayment Gold Loan: 35%

*No additional appraisal of pledged gold is required on the time of two subsequent renewals, topic to the pledged gold remaining within the custody of the Bank.

-Security : Pledge of gold ornaments duly verified for high quality & amount.

-Processing Fees: Nil (Till 31.03.2023)

-Others : Gold appraiser fees might be paid by the Applicant.

Eligibility

Age: 18 years and above

Profession: Any particular person (singly or collectively) with regular supply of earnings together with: Bank’s Employees, Pensioners.

Repayment

Repayment Mode

- Gold Loan (EMI primarily based): Repayment of Principal and Interest will start from month following the month of disbursement.

- Liquid Gold Loan (Overdraft): Overdraft Account with transaction facility.

- Monthly curiosity is to be served. The drawing energy of the account might be calculated primarily based on the present market worth of the gold declared by the financial institution on occasion.

- 3 Months Bullet Repayment Gold Loan: Interest and Principal on or earlier than finish of time period.

- 6 Months Bullet Repayment Gold Loan: Interest and Principal on or earlier than finish of time period.

- 12 Months Bullet Repayment Gold Loan: Interest and Principal on or earlier than finish of time period.

Repayment Period

Maximum:

- Gold Loan (EMI primarily based): 36 months

- Liquid Gold Loan ( Overdraft): 36 months

- 3 Months Bullet Repayment Gold Loan: 3 months

- 6 Months Bullet Repayment Gold Loan : 6 months ,

- 12 Months Bullet Repayment Gold Loan: 12 months

Documents Required: To Apply Loan:

- Application for Gold Loan with images.

- Proof of identification with proof of Address

- Witness letter in case of illiterate debtors.

Documents Required: At The Time Of Disbursement

- Demand Promissory (DP) notice and DP Note Take Delivery Letter.

- Gold Ornaments Take Delivery Letter.

- Arrangement Letter

Arrangement Letter is supplied in onerous copy on the time of sanction of mortgage.

How To Apply For SBI Personal Gold Loan Online?

- Go to the official web site of SBI

- Click on ‘Loan’ Section

- Click on ‘Gold Loan’ choice within the ‘Loan’ Section

- A brand new web page will open, click on on ‘SBI Personal Gold Loan’ choice

- You will see the ‘Apply Now’ choice. Click on it and observe the steps

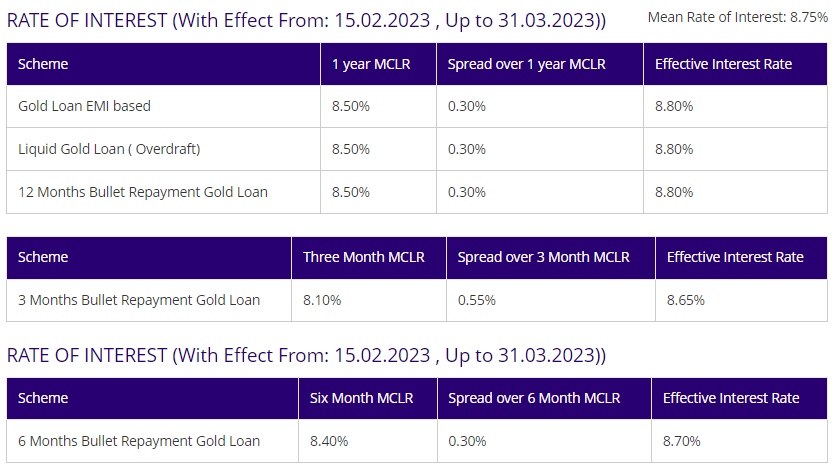

SBI Personal Gold Loan: Rate Of Interest

Read all of the Latest Business News right here