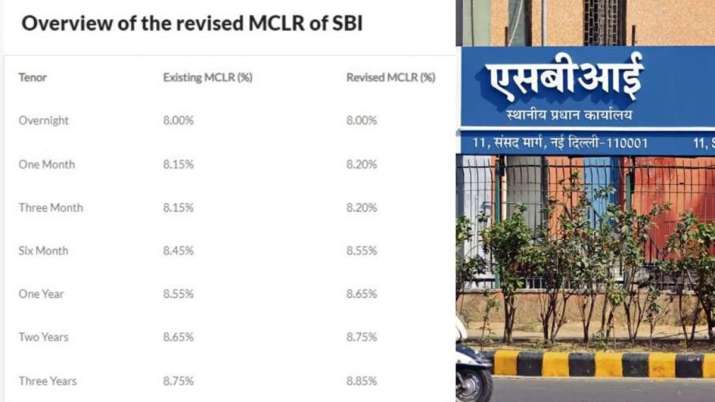

The State Bank of India (SBI) on Friday introduced an increase within the marginal price of MCLR by 5-10 foundation factors for choose tenors. This implies that the EMI of home loans, automobile loans, and personal mortgage will increase for the widespread individuals. Loans, resembling auto or home loans, will develop into dearer for debtors. The increase within the marginal price of lending charge (MCLR) of the nation’s main financial institution is now between 8 per cent and 8.85 per cent. The new charges have come into impact from December 15.

Other banks can even make loans costly

The in a single day MCLR charge has been set at 8 per cent, whereas the charges for one-month and three-month tenors have been elevated to 8.20 per cent from 8.15 per cent. SBI is the main financial institution within the banking sector. Therefore, there’s a chance that different banks can even observe swimsuit and might increase interest charges.

Impact on the mortgage takers

The increase in MCLR will increase the month-to-month instalments (EMIs) of all varieties of loans. Customers who’re at the moment making use of for a mortgage will get the mortgage at costly interest charges. Additionally, prospects who’ve already taken a mortgage may have to pay their future instalments at this elevated charge. However, it will be important to observe that MCLR-based loans have a reset interval, after which the charges are revised for the borrower.