FILE PHOTO: AI (Artificial Intelligence) letters are positioned on laptop motherboard in this illustration taken June 23, 2023.

The 2022-23 report on the developments in, and progress of, banking in India, which was launched on Wednesday by the Reserve Bank of India (RBI), research the use of Artificial Intelligence (AI) in banks and the way it has grown over time. To assess the extent of consciousness and readiness for adopting AI in Indian banks, an analytical examine was performed on banks’ annual reviews by the RBI employees between 2015-16 and 2021-22.

This examine employed a textual evaluation methodology by matching key phrases particular to the area and utilising named entity recognition methods. It leveraged extensively recognised AI and Machine Learning (ML) dictionaries and glossaries from sources akin to Google Vertex AI, Google Developers, IBM, NHS AI Lab, and the Council of Europe. Additionally, insights from Large Language Models akin to ChatGPT and Bard have been built-in into the evaluation.

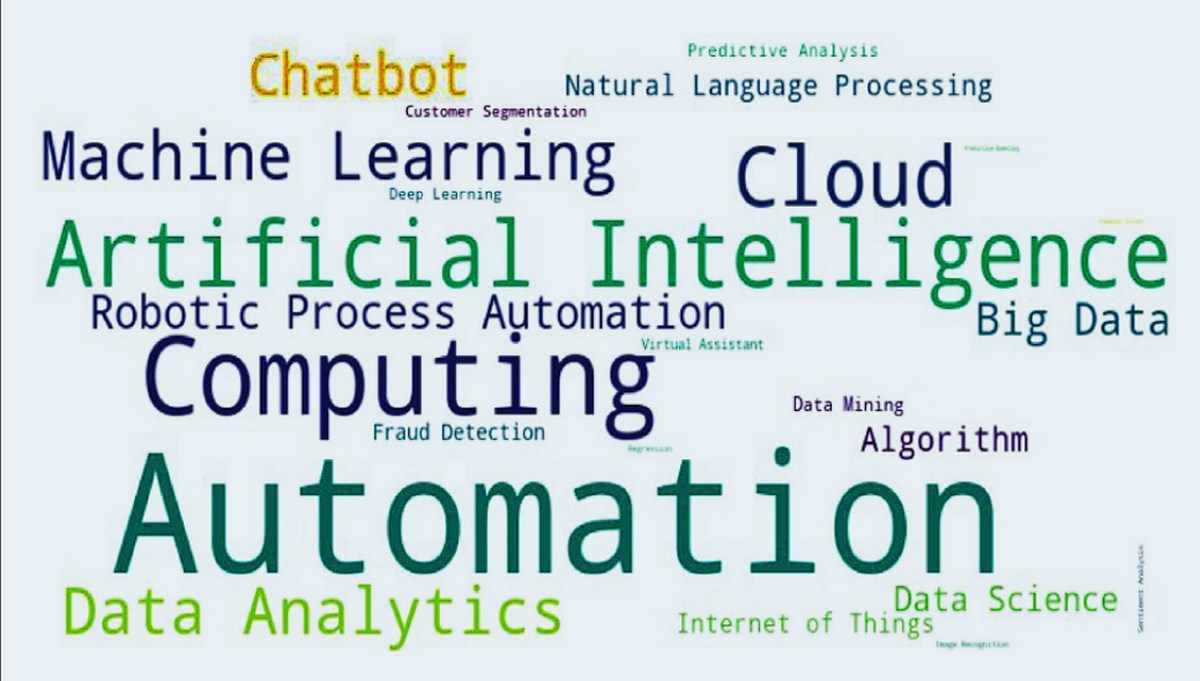

Chart 1 | The chart exhibits a phrase cloud displaying textual evaluation of AI-related key phrases in the financial institution’s annual report.

Charts seem incomplete? Click to take away AMP mode

The evaluation utilizing a phrase cloud signifies a big emphasis by banks on automation (Chart 1). This pattern seemingly stems from the aim of enhancing effectivity and enhancing capabilities in the detection of fraud and different varieties of predictive analytics, the RBI examine suggests. It can be notable that there’s an consciousness or potential for adopting rising applied sciences akin to Robotic Process Automation, the Internet of Things, and Natural Language Processing.

A key utility of AI in varied service sectors is the use of chatbots, that are succesful of partaking in conversations with human customers in pure languages, both by way of textual content or voice.

Chart 2 | The chart exhibits the quantity of banks in India which adopted chatbots. in complete, 33 scheduled industrial banks have been analysed.

In FY17, solely 5 banks had opted for this facility. This incrementally grew in the next years. Now, 26 banks have this facility.

Chart 3 | The chart exhibits the share of banks in India which have adopted chatbots by the top of June 2023.

Over 78.8% of the banks have adopted this facility — i.e., 26 out of the 33 scheduled industrial banks analysed. According to the examine, 11 out of 12 public sector banks (PSBs) had some type of chatbot and digital assistant by utilizing AI and ML applied sciences, by the top of June 2023. On the opposite hand, solely 15 out of 21 non-public sector banks (PVBs) had them.

Click to subscribe to our knowledge publication line

Chart 4 | The chart exhibits the expansion in the share of PSBs and PVBs which adopted chatbots over time.

The share of PVBs with chatbots was considerably increased than the share of PSBs in FY17. However, the state of affairs reversed in the next years, with the pattern of large-scale mergers among the many PSBs showing to have influenced the adoption of chatbots, as merged entities typically undertake the know-how from their buying banks. According to the RBI examine, non-banking monetary companies have additionally began introducing chatbots for buyer providers.

AI instruments are extensively adopted and closely utilised in areas akin to fraud detection, optimising data know-how operations, and digital advertising and marketing. The examine argues that banks can enhance effectivity and supply higher buyer experiences by leveraging these functions. The use of ML methods for real-time evaluation of buyer transactions enhances the estimation of default dangers. This bolsters their threat administration methods, the examine suggests.

However, the examine additionally ends with a cautionary word. AI in finance may heighten current dangers and introduce new ones, akin to client safety issues. The opaque functioning of AI fashions complicates compliance with legal guidelines, rules, and inner controls in monetary companies. These fashions might set off market shocks and amplify systemic dangers, notably in phrases of procyclicality, the examine warns.

Source: ‘Adoption of Artificial Intelligence in Indian Banks’, printed in the Report on Trends and Progress of Banking in India 2022-23 by the Reserve Bank of India.

Also learn: Data | Private banks on a housing mortgage spree, 99% pay dues on time as of now

Listen to our Data podcast: Examining the 70-Hour Work Week: Insight or Imposition by Infosys’ Narayana Murthy | Data Point Podcast