Suryoday Small Finance Bank is additionally providing rate of interest as much as 7 per cent to its financial savings account buyer in above Rs 5 lakh as much as Rs 2 crore slab.

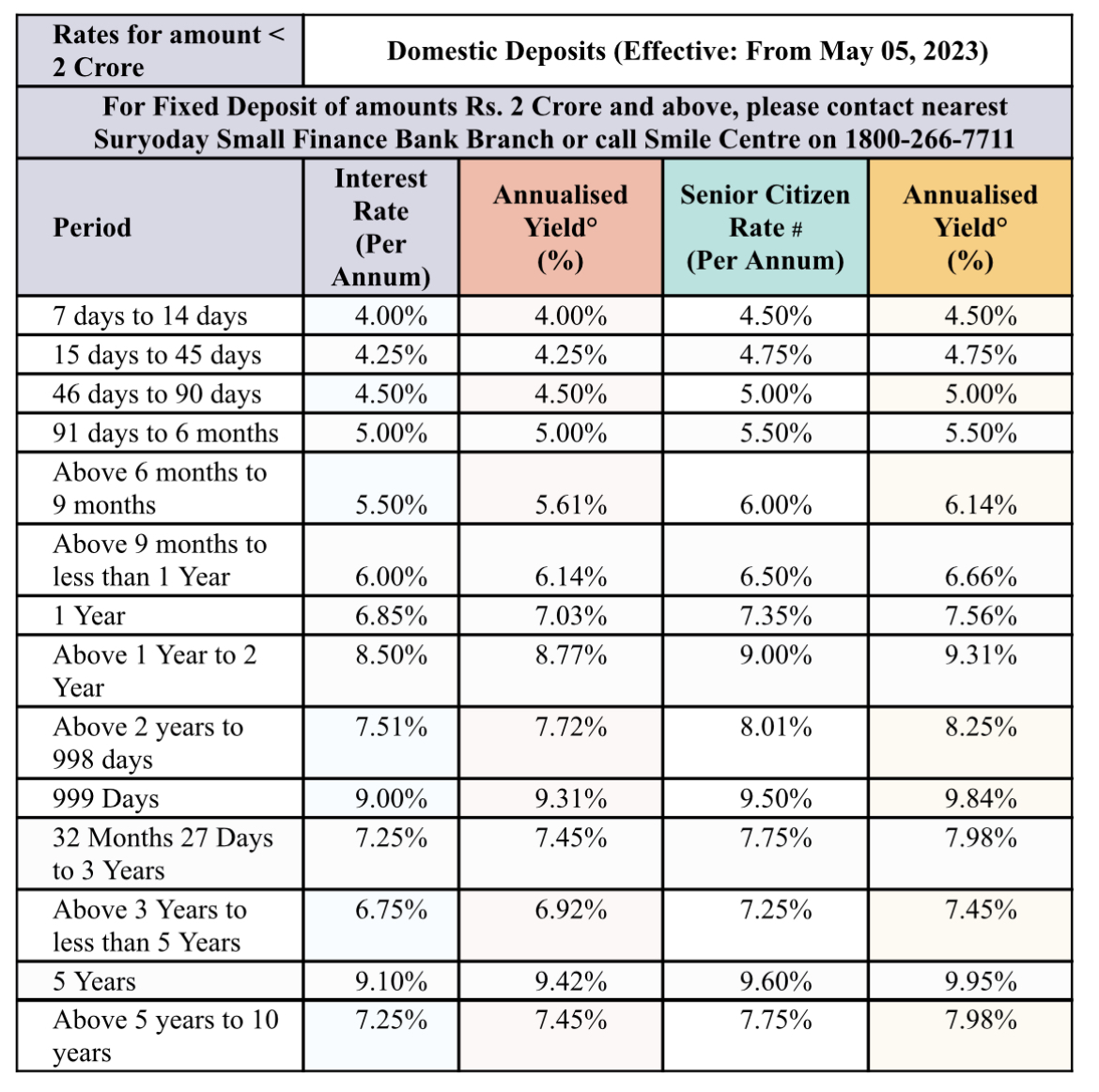

Suryoday Small Finance Bank is now accepting FDs of lower than Rs 2 crore maturing in 7 days to 10 years at an rate of interest of 4 per cent to 9.10 per cent to most people and 4.50 per cent to 9.60 per cent to senior residents

Suryoday Small Finance Bank (SSFB) has revised rates of interest on it mounted deposits (FD), efficient Friday, May 5, 2023. Interest charges on deposits of lower than Rs 2 crore with 1 to 5-year tenure have been revised upwards by 49 to 160 foundation factors (bps). After the most recent hike, the financial institution is now accepting mounted deposits of lower than Rs 2 crore maturing in 7 days to 10 years at an rate of interest of 4 per cent to 9.10 per cent to most people and 4.50 per cent to 9.60 per cent to senior residents.

“Regular clients can now get 9.10 per cent rate of interest on 5-year deposit, whereas senior residents can get a 9.60 per cent rate of interest. The financial institution is additionally providing rate of interest as much as 7 per cent to its financial savings account buyer in above Rs 5 lakh as much as Rs 2 crore slab. This is the very best rate of interest that the financial institution affords to its clients, additionally your deposits are backed by DICGC on this financial institution, investing determination quickly will lead to addressing your mid-term objectives of 5 Years,” Suryoday Small Finance Bank stated in an announcement.

It said, “The minimum tenure for earning FD interest is 7 days. The rate applicable on premature withdrawal would be 1 per cent less than the rate applicable from the lower of the two — the rate for original /contracted tenure for which the deposit has been booked (as on the date of booking the deposit); the rate for the actual tenure for which the deposit was in force with the Bank (as on the date of booking the deposit).”

The financial institution additionally stated that as rates of interest are topic to vary with out prior discover, depositors shall confirm the charges on the worth date of FD.

Read all of the Latest Business News, Tax News and Stock Market Updates right here