Check all particulars about Muthoot Gold Loan.

As a secured product, this mortgage requires the gold to be pledged as a collateral and valued

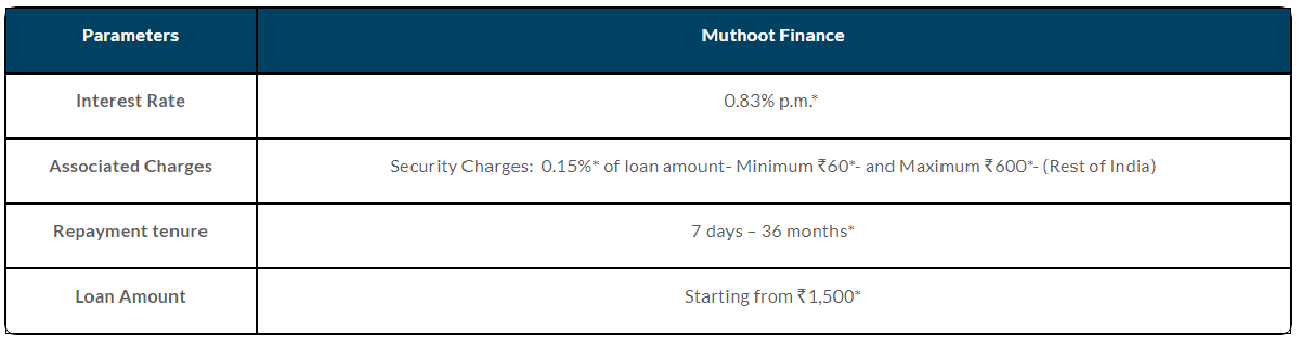

As rates of interest within the nation have been on the rise since final 12 months amid excessive inflation, debtors are searching for choices to get a less expensive mortgage. One such possibility will be gold mortgage, which is cheaper than a private mortgage. Here are particulars about Muthoot Finance Gold Loan:

As a secured product, this mortgage requires the gold to be pledged as a collateral and valued. However, Muthoot Finance gives the doorstep valuation of the gold. This provides to the comfort and assures the security of gold objects.

In addition to aggressive rates of interest, a gold mortgage from Muthoot Finance comes with the next advantages — Flexible compensation tenure, no restriction on finish use, easy-to-meet eligibility standards, minimal documentation, straightforward half and full prepayment facility, and no hidden fees.

Muthoot Finance gives gold mortgage on rate of interest as little as 0.83 per thirty days. Its different fees embrace safety fees: 0.15 per cent of mortgage quantity (minimal Rs 60- most Rs 600). Its compensation tenure is 7 days-36 months.

How to Apply

Step 1: Click on ‘APPLY NOW’ on this web page.

Step 2: Enter particulars like your title, cell quantity, and date of beginning. Then, choose the state, metropolis, and nearest department.

Step 3: A mortgage consultant will contact you to course of your software additional.

Eligibility

1) You needs to be older than 18 years

2) You should be an Indian citizen

Documents Required

1) Proof of id (PAN Card, Aadhaar card, Voter ID card, Passport)

2) Address proof (Aadhaar card, Voter ID card, Passport) or utility payments.

The last goal of a gold mortgage quantity just isn’t constrained, not like the one goal of different secured loans like a house mortgage or schooling mortgage.

Read all of the Latest Business News right here